In spring 2025, the Nasdaq fell by more than 25%. Rather than enduring the decline, Sébastien (Investment Advisor within Norman K.’s Asset Management team) adjusted his client portfolios to seize the opportunity. He reflects on the financial strategy implemented, the client relationship, and the bespoke approach that defines Norman K.

Hello Sébastien, to begin with, could you introduce yourself in a few words?

Hello,

I’ve been an Investment Advisor at Norman K. for almost 3 years.

On a daily basis, I manage my clients’ portfolios with a dual mission: to generate performance, whilst maintaining good relationships.

My role is not only to manage assets, but also to support clients over the long term, ensuring their portfolios remain aligned with their objectives while navigating changing market conditions.

Before going into detail, let’s go back to the starting point of the operation. What was the context and how did you approach this phase?

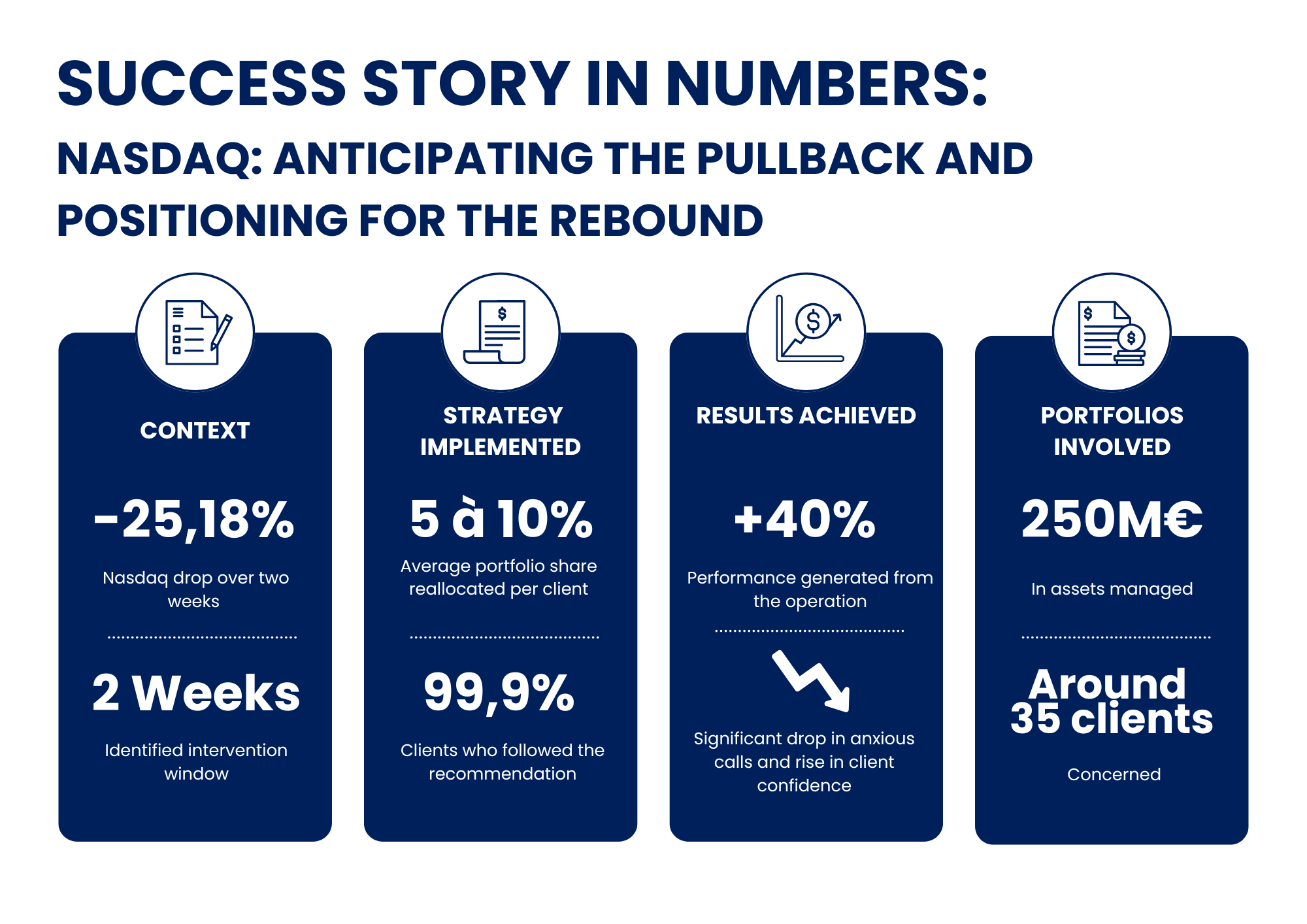

Last April, following the announcement of Donald Trump’s new customs tariffs during what was referred to as “Liberation Day,” the US market experienced a sharp decline: the Nasdaq fell by more than 25% in roughly two weeks.

At that time, most of my client portfolios were predominantly bond-based, and therefore relatively defensive, with quarterly, semi-annual or annual coupons. We remained focused on an income-oriented strategy.

When the market collapsed, I began gradually reducing the bond allocation to increase exposure to equities, particularly the Nasdaq and, in some cases, the MSCI World.

The objective was to take advantage of an excellent entry window, at a time when valuations were falling sharply (and in our opionion sometimes irrationally), according to our Analysts.

This period naturally created many exchanges and tensions on the client side. What was the main challenge?

Convincing clients.

The market shock was severe. Clients were seeing red across their positions, so proposing to invest at a time when markets were down required a great deal of explanation.

Today, I manage a book of around thirty clients, which implies frequent interactions and very different reactions depending on individual profiles.

It involved frequent calls and updates and close monitoring. With long-standing clients, trust was already established thanks to the performance built over the previous years. For newer clients, it was essential to explain the rationale, provide reassurance and remain highly available for any questions. During stressful market phases, the relational approach plays a crucial role.

In these stressful periods, the relational approach plays a key role. What made the difference in your approach?

Responsiveness and proximity.

At Norman K., the client relationships are direct and flexible, without the unnecessary administrative complexity our competitors face. Unlike traditional banks, we’re not limited to formal channels. Having direct access to clients, understanding their profile and their risk tolerance, allows us to adjust our investment stratergy without delays. This quick repositioning clearly paid off.

In this case, we proposed this repositioning only to clients whose portfolios and objectives aligned, reflecting our bespoke approach. Even with measured allocations, this strategy generated. When a decision is made with clear rationale during a period of uncertainty and proves successful, trust becomes long-lasting making subsequent steps easier to propose.

Clients who participated benefited from the recovery, gained confidence, and were more open to considering new allocations.

What results were achieved?

Between April 7 and April 21, the Nasdaq fell by 25.18% (source: Nasdaq Index, April 2025). Since our entry point, the market has rebounded by approximately 40%, allowing clients to benefit from the recovery momentum.

One of the key factors was remaining rational during a highly stressful market phase, which is never easy when clients are worried about declining portfolio values. We succeeded in staying disciplined—averaging down existing positions for some clients and opening new positions for those who did not yet have exposure. This strengthened our credibility and, above all, client trust, because as portfolio managers, our role is also to make market decisions at the right time.

This also highlights the way teams collaborate at Norman K. How does this operation illustrate the strength of the Norman K. model?

The platform-based approach is reflected in our ability to connect expertise.

For direct financial operations, the Corporate Advisory team presents opportunities to us (fundraising, growth capital, etc.). If we believe in them, we take over the case and propose it to clients whose objectives and expectations we know well. The same logic applies with the Financing team, particularly for private real estate debt transactions.

The autonomy of Investment Advisors, combined with their deep understanding of client portfolios, allows us to quickly select relevant opportunities while remaining fully aligned with our clients’ best interests.

Interview conducted by A.F., Head of Marketing & Communication at Norman K., with Sébastien, Investment Advisor within the Asset Management team at Norman K.

Interview conducted by A.F., Head of Marketing & Communication at Norman K., with Sébastien, Investment Advisor within the Asset Management team at Norman K.